private placement life insurance canada

A specialized team in Toronto manages a diversified portfolio of private placements. Reviews Trusted by 45000000.

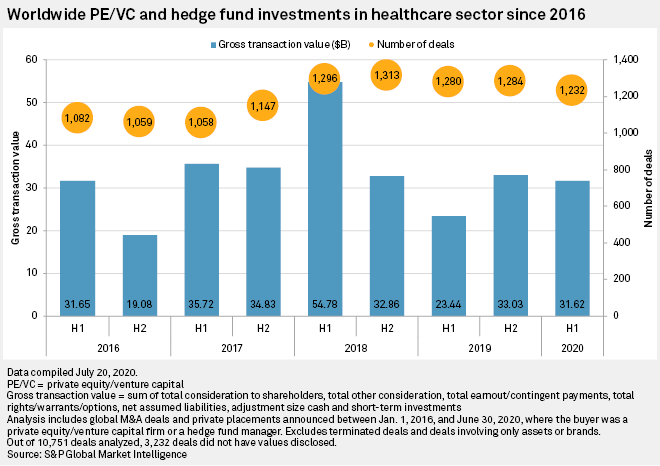

Biotechnology Draws 12 6b From Private Equity Venture Capital Activity In H1 S P Global Market Intelligence

Ad Rates start as low as 149 per 50000 of coverage.

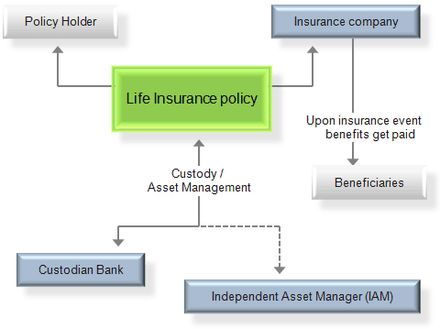

. Private placement life insurance PPLI is a variable life policy which is not registered with SEC PPLI includes unregistered investment subaccount options in addition to registered investment subaccounts typically available in registered variable life VUL policies. Private placement life insurance or PPLI is a customized version of variable rate insurance not available to the general public. Often shortened to PPLI Private Placement Life Insurance was originally designed for those who want to invest in hedge funds For wealthy investors in a high tax bracket who want to invest their money anyway it often makes sense to have their money within a.

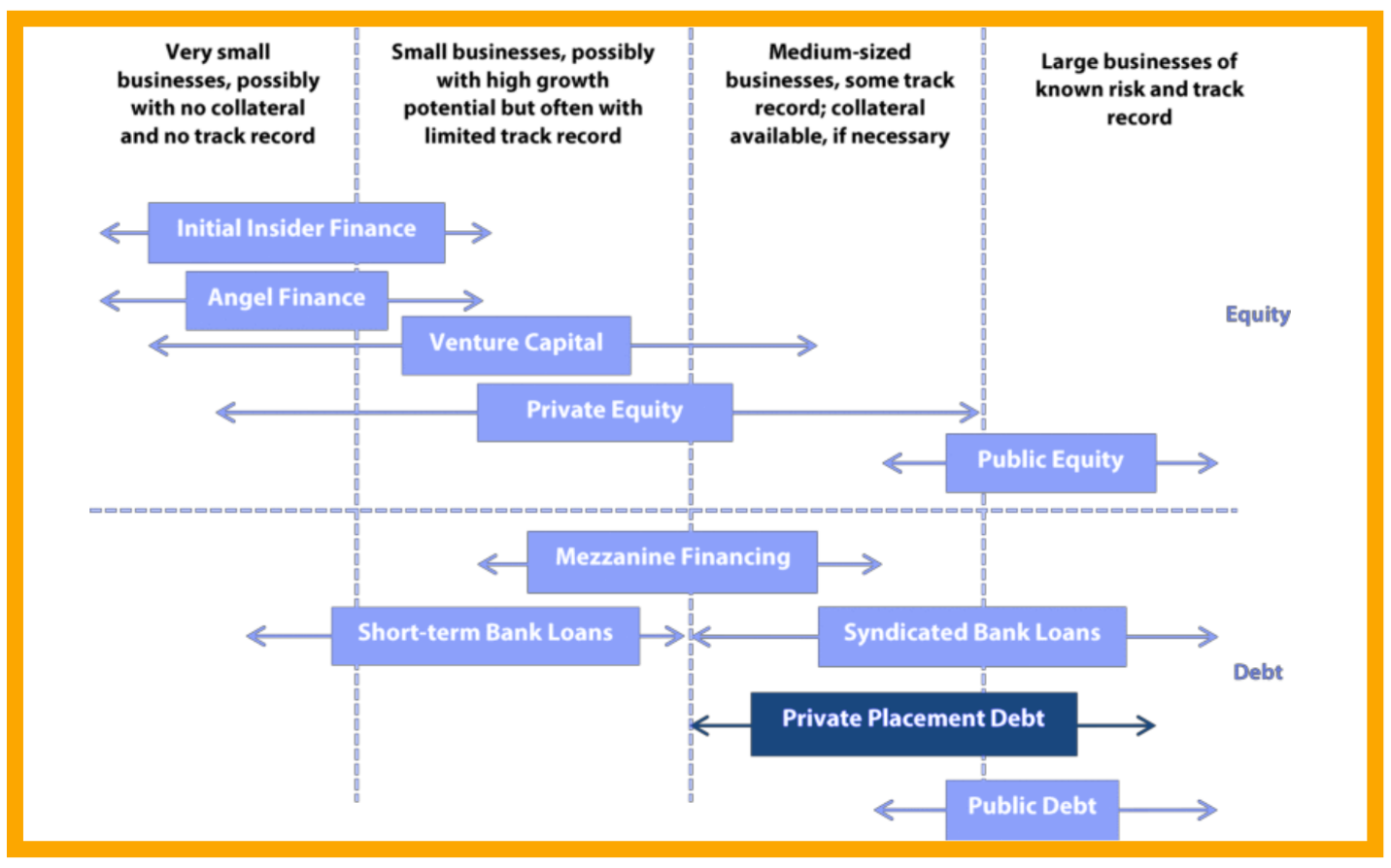

Even the staunchest life insurance critic will usually admit that permanent life insurance can benefit wealthier people. Private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a. Private placements are bond investments made through private agreements with various borrowers.

Private placement life insurance PPLI in contrast is a privately negotiated life insurance contract between insurance carrier and policy owner. Private Placement Life Insurance PPLI is a variable universal life insurance product designed for high net worth investors. A twist on variable-rate universal life insurance PPLI policies are more often offered by banks.

Simplified tax reporting eliminates many of the annual reporting requirements associated with traditional hedge funds. It is designed to appeal to high net worth individuals who are interested in funding the policy with a large up-front premium. Ad Secure your familys financial future with term life insurance with Ethos.

Key benefits of PPLI compared to traditional. Investments by term Millions Percentage. Private placement life insurance ppli is a niche solution designed for.

Private Placement Life Insurance If ownership is structured properly eg in an irrevocable trust life insurance proceeds may be free from estate taxes as well. The little-known advantages of private-placement life insurance. Apr 04 2018 what is private placement life insurance.

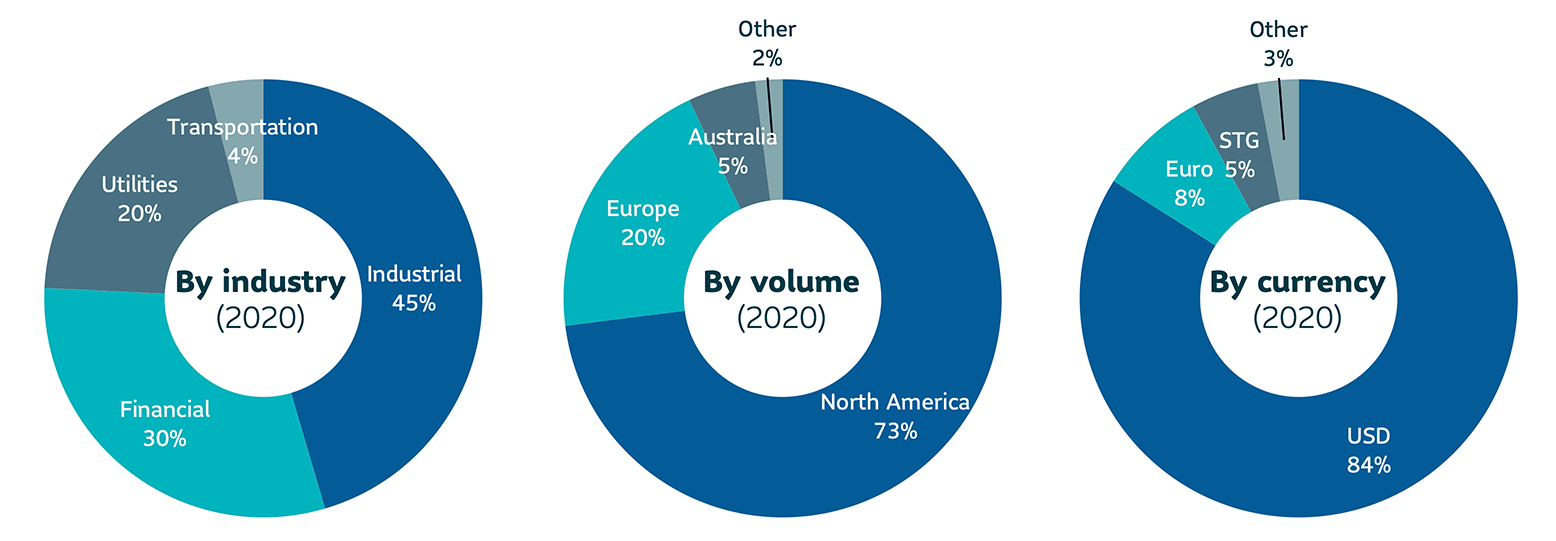

The term of the policy is linked to this persons life. Private placements are managed by a specialized private placement area located in Toronto. Because of their considerable assets high-net-worth clients often have a greater need for and greater access to specialized financial products.

Private placement life insurance emphasizes life insurance as an investment strategy with tax advantages. Private placement life insurance refers to policies that have features that are not available in other policies available for sale to the general public. Private placement life insurance if ownership is structured properly eg in an irrevocable trust life insurance proceeds may be free from estate taxes as well.

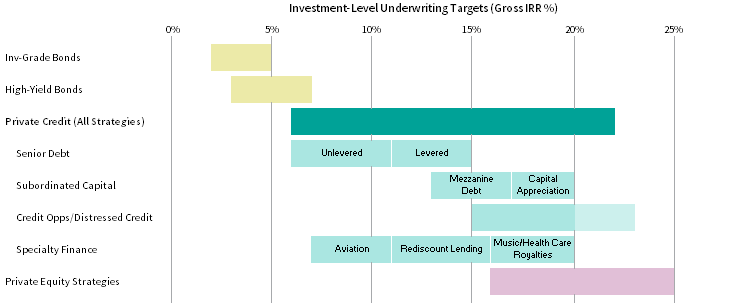

Apply for coverage in minutes with Ethos. PPLI encompasses a broad range of specific life insurance and annuity policies that typically have large face amounts and underlying investments that include private placement securities such as hedge funds private equity or other alternative investment categories such as commodities or real estate. SOME BENEFITS OF PRIVATE PLACEMENT LIFE INSURANCE AND ANNUITIES.

Ad Compare the Best Life Insurance Providers. What is Private Placement Life Insurance. 60 per cent Investment guidelines Private placements are bond investments made through private agreements with various borrowers.

Canada life and design are trademarks of the canada life assurance company. It is offered by both domestic and foreign insurance companies and provides policy holders with sophisticated asset management choices. Proportion of total assets of the Canada Life participating account.

Canada Life and design are trademarks of The Canada Life Assurance Company. PPLIs are structured as variable universal life insurance policies. Yet because PPLI comes with certain fees and other limitations only a careful case-by-case analysis can determine whether PPLI is right for a given client and situation.

The insured person must be a private individual. An overview of the current lay of the land in ppli. PPLI offers several advantages compared to standard policies.

Private placement life insurance PPLI. Use our quote tool to learn more. Private placement life insurance webinar.

Page 1 of 1 46-5055Z EL 1220. QA Private Placement Life Insurance What is Private Placement Life Insurance. Private placement life insurance ppli is a niche solution designed for wealthy individuals.

Policy funds are held in segregated accounts that theoretically protect the funds against the carriers creditors. Tax-deferred growth under Internal Revenue Code Section 7702 g 1 A Total transparency. When the insured person dies the contract normally comes to an end.

A perfect case in point. Private placement life insurance is a variable universal life insurance policy that provides cash value appreciation based on a segregated investment account and a life insurance benefit. However it is possible to have two people insured joint-insured.

A diversified portfolio is maintained. While I usually take issue with the only for the wealthy commentary about insurance private placement life is. Each expense is explicit and visible to you as the holder of the insurance contract.

Private Placement Life Insurance PPLI is a sophisticated vehicle that acts as an insurance policy that provides death benefit coverage while at the same time allowing for a variety of registered and non-registered investment options and a potential for significant growth in cash surrender value in a tax-efficient manner. Private placement life insurance PPLI is a niche solution designed for wealthy individuals who want to invest in hedge funds but avoid the associated high tax rates. For those who have at least a few million dollars and have a high income Private Placement Life Insurance is advisable.

Private Placement Life Insurance. PIPSC Members join ServicePlus for free to get group life insurance.

5 Mba Students Of Apeejay Institute Ramamandi Jalandhar Are Selected In Extramarks At 4 2 Lakh Package In Online Campus Placemen Mba Student Campus Student

Private Placement Life Insurance Explained Wealth Management

How Does Private Placement Life Insurance Work Valuepenguin

What To Do While You Are Waiting For A Foster Child The Fosters Foster Parenting Becoming A Foster Parent

Law Firm For Private Equity And Pension Fund Investments

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

Private Placement Life Insurance Wikiwand

Mathew Ledvina Family Background Matthews Three Year Olds Cash Machine

Real World Private Placement Examples And Their Impact On The Businesses

Private Placement Life Insurance Ppli The Who What Where And Why Not And How Much Lake Street Advisors

Investment Grade Private Credit Recap And Outlook

As The Stock Market Becomes Volatile And Unpredictable People Are Seeking Safe Investment Methods At Such A Time Alt Financial Planning How To Plan Financial

How To Complete A Private Placement

Latest Research Perspectives Cambridge Associates

Parental Leave Checklist For Expecting Moms And Dads Maternity Leave Planning Parental Leave Expecting Moms

Megajobfair List 1 Of The Companies In Campus For 22nd August 2017 All The Best To Every Candidate For The De Job Fair Private University University

Before You Head To The Dealership Or Start Shopping For Cars Online Take A Look At Comprehensive Auto Ins Car Insurance Comprehensive Car Insurance Insurance

Real World Private Placement Examples And Their Impact On The Businesses